Blog

Maryland’s Tax Climate: Are We Pricing Ourselves Out of Growth?

Dec 2, 2025

Key Takeaways: Maryland's Tax Climate

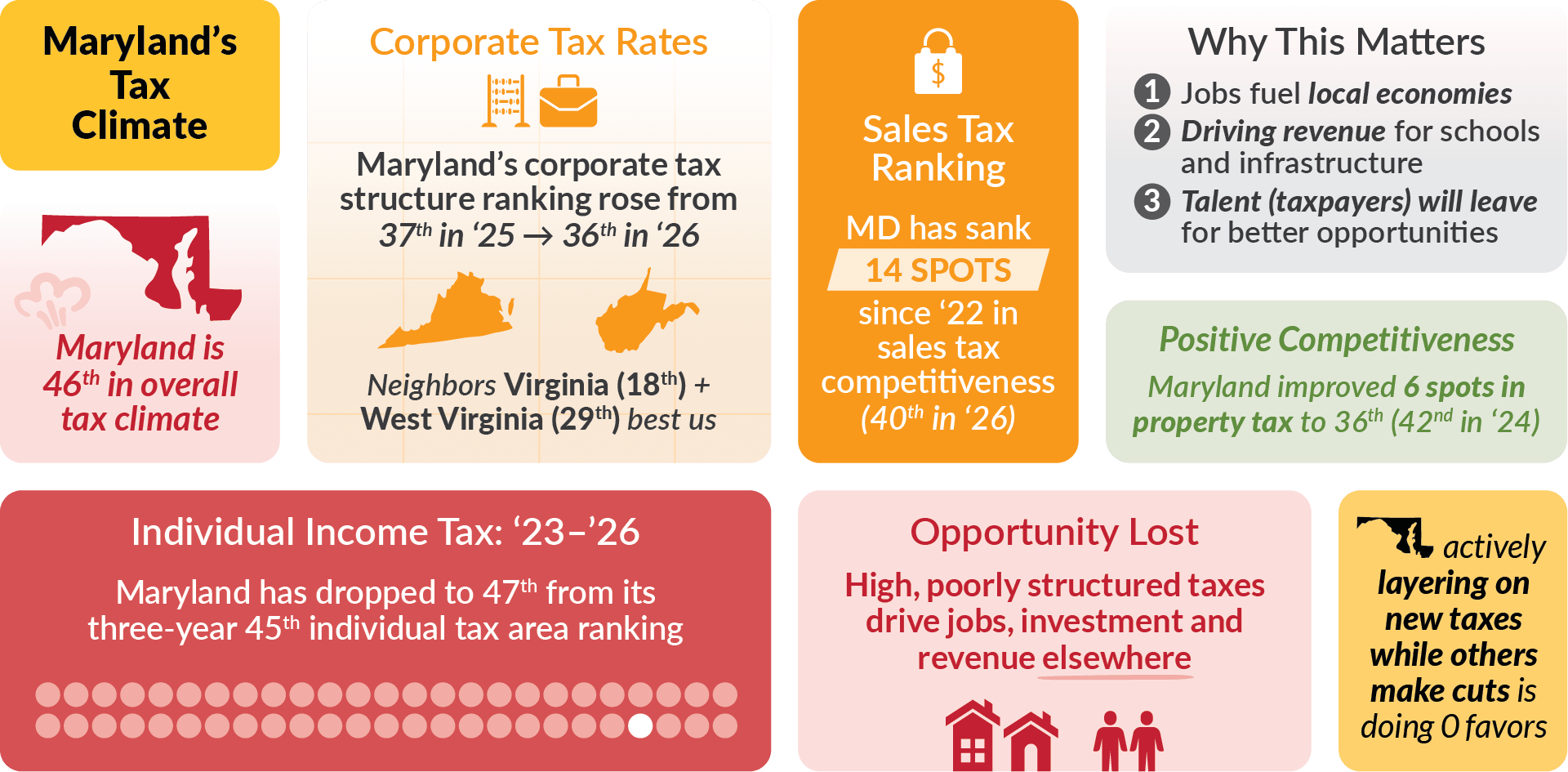

- The Tax Trap: Maryland ranks 46th in the newly released 2026 State Tax Competitiveness Index. Neighbors are pulling ahead: Virginia (30th), Delaware (24th), Pennsylvania (36th). This isn’t just about high rates — it’s a complex, unpredictable system that makes Maryland an outlier.

- What’s Driving It: Maryland keeps rates high while neighbors reduce theirs. 2025 legislation expanded income brackets, added new surcharges and increased local taxes, raising costs for residents and employers. Businesses face added layers — corporate income tax, steep personal income taxes, sales and property taxes, UI taxes and digital advertising taxes and the new 3% tech tax. The 8.25% corporate tax rate is higher than regional competitors, and Maryland is one of the only states taxing GILTI/NCTI, a practice that increases liability.

- Spending Context: Looking ahead, Maryland’s structural budget gap (spending growth at 5.8% vs. revenue growth at 3.4%) means the state is likely to continue turning to businesses for new revenue. In FY 2026 alone, businesses are expected to cover about 68% of new general fund revenues.

Why Maryland Keeps Losing Out

Picture this: You’re a business owner planning your next expansion. On the shortlist: Maryland, Virginia, Pennsylvania, Delaware — maybe North Carolina or Texas.

You run the numbers. Maryland shows up with higher rates, layered taxes, and policy uncertainty. It doesn’t even make the finalist round. That lost decision means fewer jobs, less investment and weaker revenue for Maryland — and it’s happening too often.

Where Maryland Stands Today

Maryland ranks 46th in the 2026 State Business Tax Climate Index — essentially unchanged for a decade.

Regional comparison:

- Virginia: 30th overall, 6% corporate tax

- Delaware: 24th overall, 8.7% corporate tax

- Pennsylvania: 36th overall; 7.99% corporate tax with plans to reduce to 4.99% by 2031

- West Virginia: 32nd overall; 6.5% corporate tax

- North Carolina: 13th overall; 2.25% corporate tax

- Maryland: 8.25% corporate tax — 9th highest nationally, and a weak 36th in corporate tax structure

The problem isn’t only the corporate tax rate. Maryland adds layers other states don’t — a $25,000 limit on first-year expensing (vs. $1 million in most states), the nation’s only digital advertising tax, a new 3% tech tax, and the distinction of being the only state with both estate and inheritance taxes.

Table 1: 2026 Tax Climate Rankings (Tax Foundation)

| MD '22 | MD '23 | MD '24 | MD '25 | MD '26 | VA '26 | PA '26 | DE '26 | WV '26 | |

| Overall Ranking | 46 | 46 | 45 | 46 | ≡ 46 | 30 | 36 | 24 | 32 |

| Corporate Tax Structure | 33 | 33 | 33 | 37 | + 36 | 18 | 34 | 50 | 29 |

| Individual Income Tax | 44 | 45 | 45 | 45 | – 47 | 36 | 38 | 43 | 27 |

| Sales Tax | 26 | 30 | 34 | 39 | – 40 | 13 | 24 | 2 | 33 |

| Property Tax | 43 | 42 | 42 | 35 | – 36 | 24 | 13 | 2 | 19 |

| Unemployment Insurance Tax | 46 | 41 | 43 | 35 | + 18 | 37 | 34 | 2 | 24 |

The Tax Foundation's State Business Tax Climate Index is a relative ranking that measures how friendly (or unfriendly) a state’s tax structure is for businesses. It looks at corporate income tax, individual income tax, property tax, sales tax and unemployment insurance tax. Lower scores = greater competitiveness.

Maryland’s Tax Burden Highest in the Region: Maryland’s effective tax burden is 10.04%, the highest in the region and 9th highest nationally. This is driven by one of the steepest personal income tax burdens in the country, recently made worse by 2025 changes.

Table 2: 2025 Effective Tax Burden, Regional Comparison (WalletHub)

| Total Burden | Income Tax | Property Tax | Sales Tax | |

| North Carolina | 8.18% (35th) | 1.98% (42nd) | 2.80% (20th) | 3.40% (26th) |

| Virginia | 8.86% (23rd) | 2.89% (18th) | 3.26% (12th) | 2.71% (44th) |

| West Virginia | 8.85% (24th) | 2.21% (37th) | 2.81% (19th) | 3.83% (16th) |

| Pennsylvania | 8.58% (30th) | 2.63% (26th) | 2.74% (22nd) | 3.21% (32nd) |

| Maryland | 10.04% (9th) | 4.47% (3rd) | 2.63% (26th) | 2.94% (38th) |

| Deleware | 6.52% (44th) | 1.81% (46th) | 3.69% (8th) | 1.02% (49th) |

Note: Rankings predate new taxes passed in 2025.

Effective Tax Burden: The share of total state income paid in taxes. This data shows how much residents and businesses actually pay relative to their earnings.

Table 3: 2025 Corporate Tax Rate Rankings (Tax Foundation)

| Tax Rate | Corporate Tax Rate | Corporate Tax Structure | |

| North Carolina | 2.25% | 45th | 3rd |

| Virginia | 6.0% | 26th | 18th |

| West Virginia | 6.5% | 21st | 29th |

| Pennsylvania | 7.99%* | 13th | 34th |

| Maryland | 8.25% | 9th | 36th |

| Deleware | 8.7% | 7th | 50th |

*Pennsylvania is phasing down from 9.99% to 4.99% by 2031 — an aggressive competitiveness move.

Tax Climate Isn’t Just One Number. Businesses don’t just look at corporate rates — they look at the total cost of operating here: corporate taxes, individual income taxes, sales and property taxes, unemployment insurance and compliance complexity. In Maryland, layering and unpredictability make the system harder and more expensive than in neighboring states.

Trend Snapshots: Where Maryland Is Worse, Stagnant, or Improving

Maryland's movement from 2022 to 2026 across tax components (lower the ranking, the better):

- Corporate Tax Rank: 33 → 36 (worse)

- Income Tax Rank: 45 → 47 (worse)

- Sales Tax Rank: 26 → 40 (worse)

- Property Tax Rank: 43 → 36 (improving)

- Unemployment Insurance Tax Rank: 46 → 18 (improved)

Why It Matters for Maryland Families

When businesses choose other states, Maryland loses:

- Jobs and investment that fuel local economies

- Revenue for schools, infrastructure and services

- Young talent who leave for better opportunities

- Community vitality as costs rise and wages lag

Bottom line: Higher business costs eventually hit families through higher prices, fewer opportunities and weaker growth.

What Needs to Change

Maryland needs a multi-year plan to:

- Reduce corporate rates to regional parity

- Simplify the code to cut compliance costs

- Stop layering new taxes that erode confidence — even failed bills hurt reputation

- Require economic impact analysis before new taxes

Join Us in Fighting for a Better Path

Policymakers have a choice: double down on the status quo, or build an economy that businesses want to grow in — and people want to be part of.

Let’s make Maryland the state where:

- Employers choose to invest

- Workers choose to stay

- Families choose to build their futures

Don’t Sit on the Sidelines: Your Voice Is Needed

Maryland’s economic future depends on the choices we make now. We need to send a clear message: businesses and workers have options, and we want Maryland to be the place they choose.

Here’s how you can help make that happen:

- Join the Maryland Chamber — Stand with 7,000+ businesses who stopped millions in new taxes in 2025. Get connected to lawmakers, receive early warnings on costly legislation, and benefit from proven advocacy that protects your bottom line.

- Contribute to the Maryland Chamber PAC — Fuel the fight against harmful legislation and ensure business voices are heard when it matters most

- Sign Up to be a Maryland Business Advocate — Get alerts when action is needed and contact lawmakers to tell them how proposed policies will impact real businesses and jobs

Why It Matters

High, poorly structured taxes drive jobs, investment, and revenue elsewhere. Every bypassed project means fewer opportunities for Maryland families and communities.

Bottom Line

Maryland’s tax climate has become a competitive barrier. Unless Maryland adopts a multi-year plan to lower rates, simplify the system, and stop layering on new taxes, it will continue to lose people, businesses, and revenue to other states.