Blog

Maryland at a Crossroads: What CEOs Say About Competing for the Future

Oct 9, 2025

Key Takeaways: Maryland’s CEO Sentiment in 2025

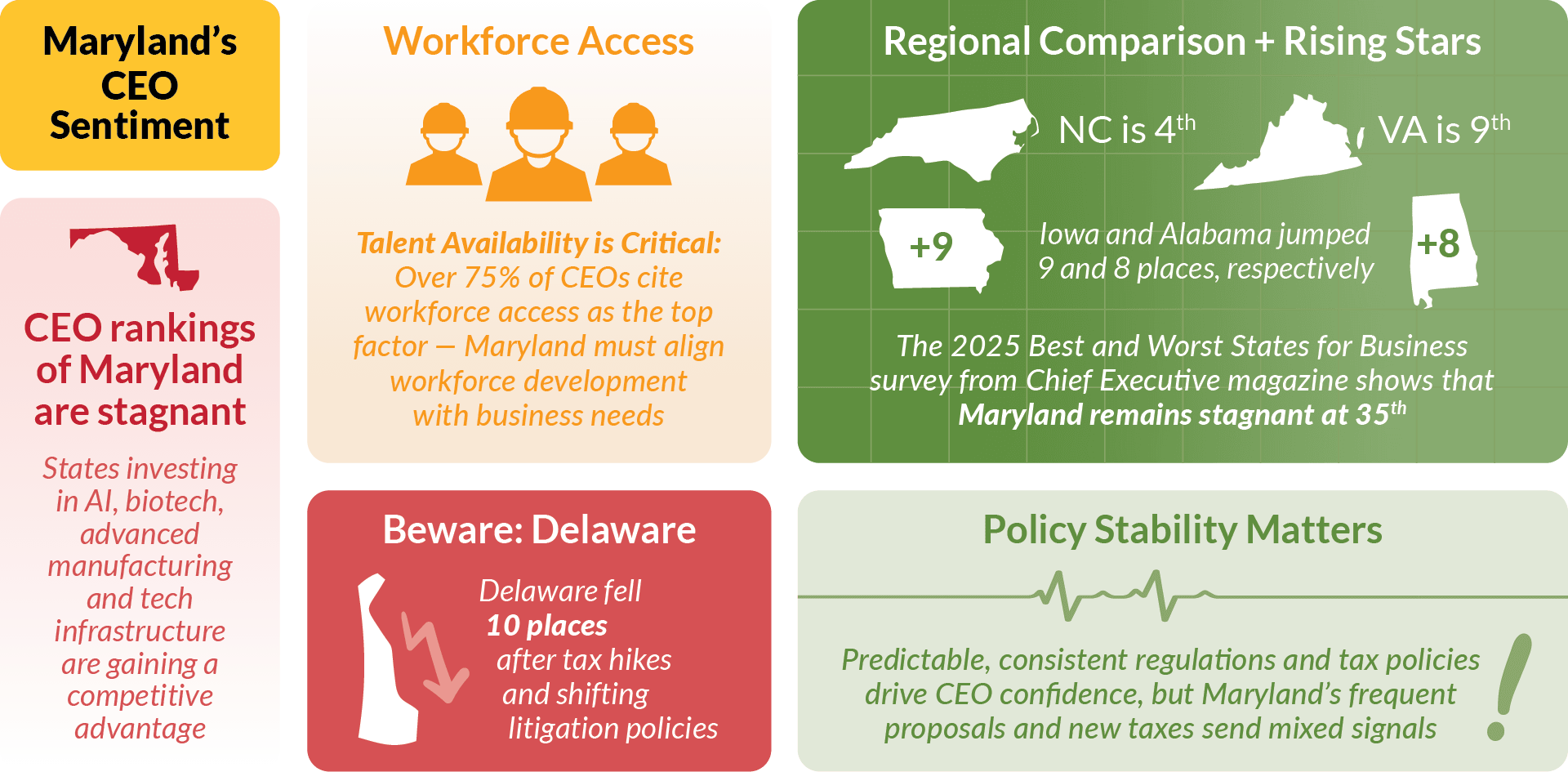

- Stagnant Performance: Maryland holds 35th place, lagging behind neighbors like Virginia (#9) and rising stars such as Iowa (+9) and Alabama (+8).

- High Costs & Regulatory Burden: Maryland’s heavy tax load, rising operational costs, and complex rules make expansion and relocation less attractive.

- Talent Availability is Critical: Over 75% of CEOs cite workforce access as the top factor — Maryland must align workforce development with business needs.

- Policy Stability Matters: Predictable, consistent regulations and tax policies drive CEO confidence. Maryland’s frequent proposals and new taxes send mixed signals.

- Innovation & Industry Investment: States investing in AI, biotech, advanced manufacturing, and tech infrastructure — like North Carolina and Iowa — are gaining competitive advantage.

Maryland at a Crossroads: What CEOs Say About Competing for the Future

Picture this: a company is planning its next major expansion. Its executives are evaluating several states — looking at costs, workforce, infrastructure and policy stability. Virginia and North Carolina are on the list, offering pro-growth policies and expanding talent pipelines. Delaware catches the eye for efficiency. Maryland is there too — but the numbers tell a tough story.

The 2025 Best and Worst States for Business survey from Chief Executive magazine shows that while neighboring states are climbing, Maryland remains stagnant at 35th. This isn’t just a ranking — it’s a warning for jobs, investment and the state’s economic momentum.

Steady Leaders and Rising Stars

Top Performers: Texas, Florida and Tennessee remain gold standards for business climate, praised for growing populations, infrastructure investments and consistent pro-business policies.

Middle-Tier Surges: Iowa (+9), Wisconsin (+9), and Alabama (+8) show the payoff of tax reform, deregulation and workforce initiatives.

Warning Signs: Delaware (-10) fell after tax hikes and shifting litigation policies; Arizona (-6), Colorado (-4) and South Carolina (-3) also lost ground.

Maryland, meanwhile, has neither surged nor fallen dramatically — but stagnation in a competitive region is itself a red flag.

Table 1: How Maryland Compares Regionally

| 2024 | 2025 | Change | |

| Maryland | 35 | 35 | ≡ 0 |

| Virginia | 12 | 9 | + 3 |

| Pennsylvania | 31 | 31 | ≡ 0 |

| Delaware | 15 | 25 | – 10 |

| West Virginia | 34 | 36 | – 2 |

| North Carolina | 5 | 4 | + 1 |

Takeaway: Maryland is holding steady — but in a fast-moving region, standing still means falling behind. Virginia and North Carolina are advancing, attracting new businesses and creating jobs. Delaware’s slip shows that even historically strong business-friendly states can falter without careful policy stewardship.

What’s Driving CEO Decisions

The survey exposes three pivotal drivers shaping the economic map:

- Policy Stability: CEOs prize predictable, consistent regulations. Maryland’s frequent tax proposals — like the Business-to-Business Services Tax, Combined Reporting and the 3% Tech Tax — signal uncertainty and slow investment.

- Talent Availability: Access to skilled workers is now the top concern. Over 75% of CEOs rank workforce as their highest priority. Maryland must align training, education and workforce initiatives with industry needs statewide — not just in Northern Virginia-adjacent corridors.

- Innovation & Industry Investment: States investing in AI, biotech, and advanced manufacturing are pulling ahead. North Carolina, Utah and Iowa lead with data centers, university partnerships and tech infrastructure that attract new businesses.

Maryland's Opportunity

The good news? The tools to compete exist.

- Tax & Cost Competitiveness: Align rates with peer states to attract investment.

- Regulatory Clarity: Streamline processes to give businesses confidence to plan and expand.

- Workforce Alignment: Expand training programs tied to in-demand industries.

- Innovation Investment: Build tech and research infrastructure that supports next-generation industries.

- Policy Predictability: Reduce uncertainty and signal stability to CEOs evaluating Maryland as a growth location.

States like Iowa and Georgia prove that strategic reforms drive measurable gains in business attraction, workforce retention and capital investment. Maryland can do the same — but decisive action is needed.

Don’t Sit on the Sidelines: Your Voice Is Needed

Maryland’s economic future depends on the choices we make now. We need to send a clear message: businesses and workers have options, and we want Maryland to be the place they choose.

Here’s how you can help make that happen:

- Join the Maryland Chamber — Stand with 7,000+ businesses who stopped millions in new taxes in 2025. Get connected to lawmakers, receive early warnings on costly legislation, and benefit from proven advocacy that protects your bottom line.

- Contribute to the Maryland Chamber PAC — Fuel the fight against harmful legislation and ensure business voices are heard when it matters most

- Sign Up to be a Maryland Business Advocate — Get alerts when action is needed and contact lawmakers to tell them how proposed policies will impact real businesses and jobs

Data Source and Survey Notes

- Rankings are from Chief Executive magazine’s 2025 Best and Worst States for Business Survey, published Spring 2025.

- The survey reflects the perceptions of 650+ CEOs and business owners nationwide.

- Rankings compare states based on business-friendliness, workforce quality, infrastructure, regulatory environment, and overall economic climate.

- The 2024 ranking data serves as the baseline to measure year-over-year changes for 2025.

- The survey captures current trends amid global trade shifts, federal policy changes, and technological advances like AI.

Why It Matters

Maryland’s lagging competitiveness affects families, communities and the economy.

Jobs at Risk: Companies may relocate or expand elsewhere, reducing local job creation.

Revenue Loss: Lower business growth limits funds for schools, infrastructure and community services.

Economic Momentum: Stagnation makes it harder to attract investment and talent, compounding the gap with neighboring states.

Bottom Line

CEOs are considering where to expand or relocate. Without strategic reforms, Maryland risks losing investment, talent and jobs to more business-friendly states.